Unlock Your Future: 5 Game-Changing Benefits of Homeownership

As a mortgage broker, it’s crucial to help your clients understand the full financial picture of homeownership. While owning a

As a mortgage broker, it’s crucial to help your clients understand the full financial picture of homeownership. While owning a

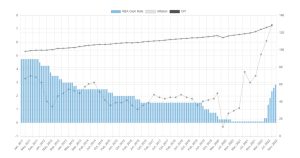

LMI a great option for first home buyers Higher interest rates and inflation are making it difficult for first home

Don’t Wait – a Mortgage Broker is able to offer lending options for those with a small deposit.

First home buyers turn to Bank of Nan and Pop Nan and Pop have always been good for

Not sure if you’ll get the thumbs up for a home loan? But you really, really like that

Buying a property is a significant milestone, and when it comes to strata properties, there are unique factors

Here’s what your journey looks like after deciding to buy a home or investment property… My services as

If the latest federal government budget is leaving you hungry for perks and savings, you’re not alone. We’ve

If you’re wondering about your borrowing limits, we’re here to help. As mortgage brokers, we delve into several key factors

Home loan headlines have been, let’s face it, a bit of a downer of late. But the good

Nobody likes missing out on a good thing. But then again, who likes overpaying? So how do you

Navigating the Decision to Engage a Buyer’s Agent: Key Considerations Before deciding whether to collaborate with a buyer’s