RBA Cash Rate Graph [ Blog ]

Comparison Graph: Above graph shows a comparison between published interest rates and the associated comparison rate.

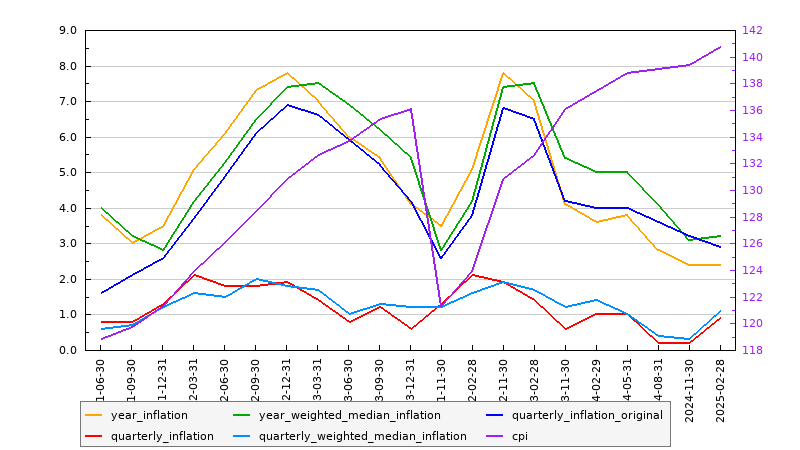

Inflation Graph [ Showing 4 Years of Data ]

Currency Conversion Graph

One Australian Dollar currency buys $0.66 USD.