RBA Cash Rate Graph [ Blog ]

Comparison Graph: Above graph shows a comparison between published interest rates and the associated comparison rate.

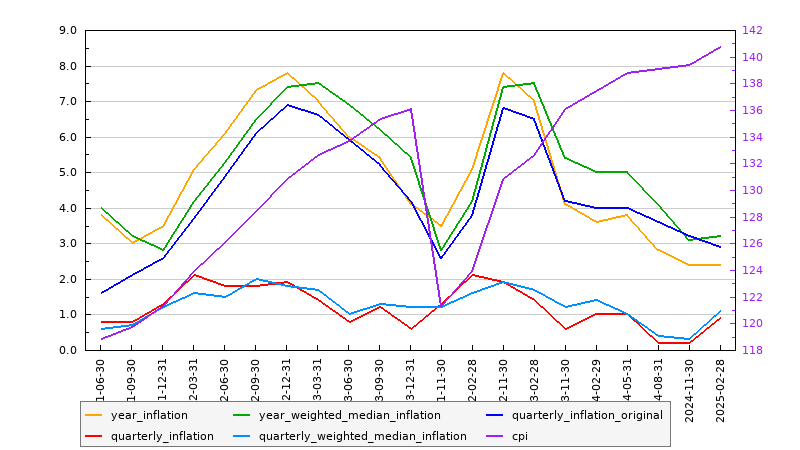

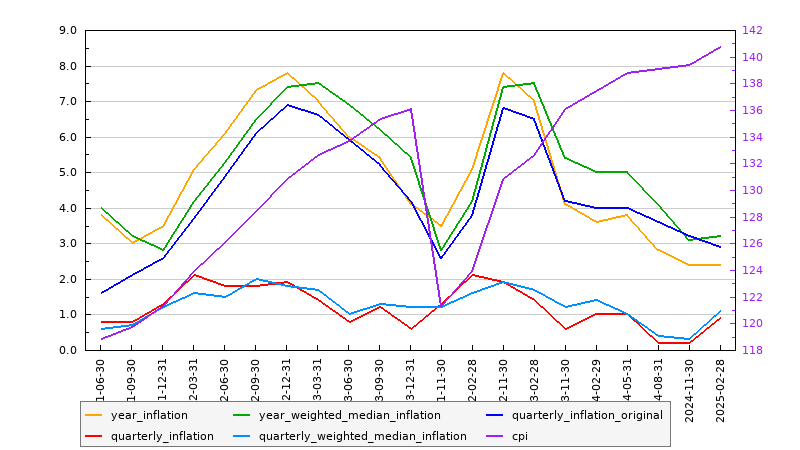

Inflation Graph [ Showing 4 Years of Data ]

One Australian Dollar currency buys $0.66 USD.

■ ■ ■

*32% of buyers didn’t look hard enough for faults*. *29% sacrificed on the number of rooms. *28% bought in a dud location. *26%

Lenders mortgage insurance (LMI) is typically applied if your deposit is less than 20% and helps protect the lender against you defaulting on your home

8-in-10 Aussies say their home is their happy place. And 85% of first home buyers believe home ownership will make them happier.* Dreaming of buying